Sgb Vs Gold Etf

Disadvantages of sovereign gold bond sgb.

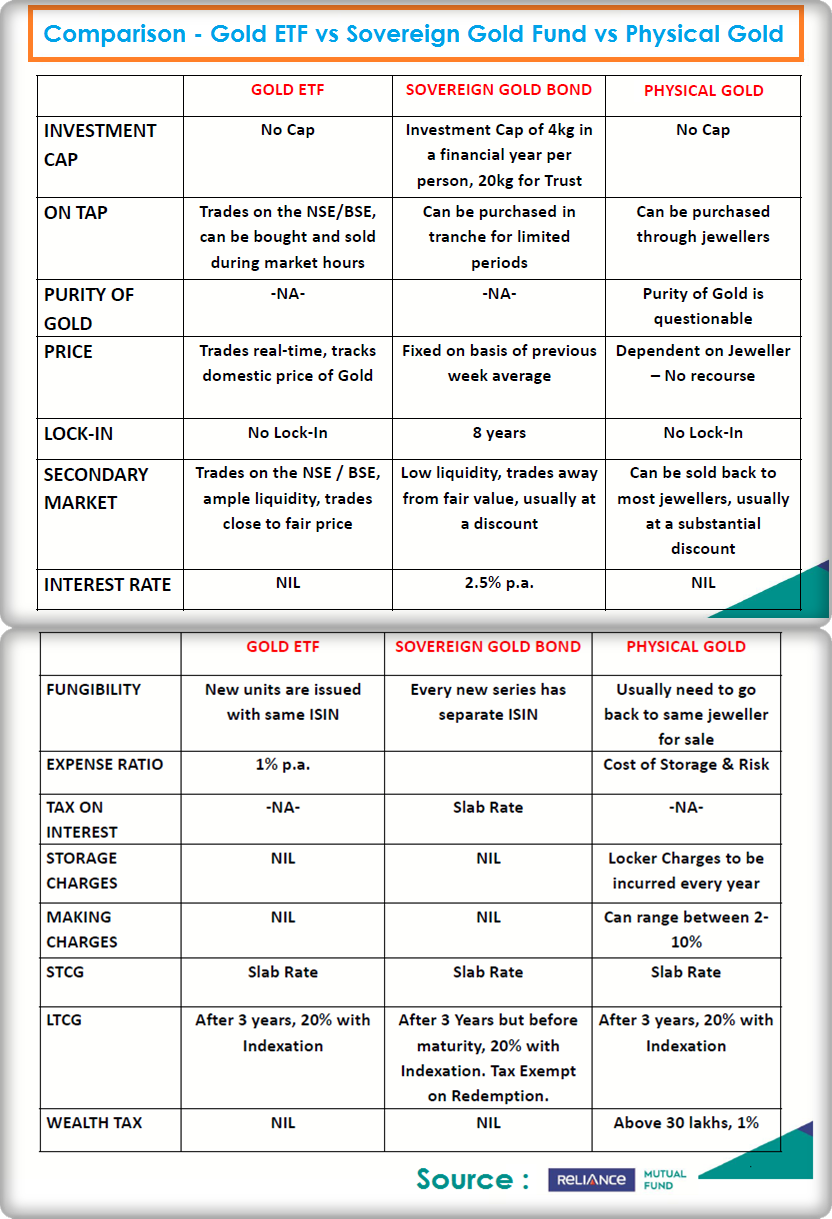

Sgb vs gold etf. Sgb can be bought or sold similar to etfs however the tax implication will be different. To buy gold etfs you need to have a trading account with any shareholder and a demat account. Gold etf vs sgb sovereign gold bond vs gold etf gold bond vs gold etf sgb vs gold etf duration. Sovereign gold bonds vs gold etf vs gold funds vs physical gold comparison of gold buying options duration.

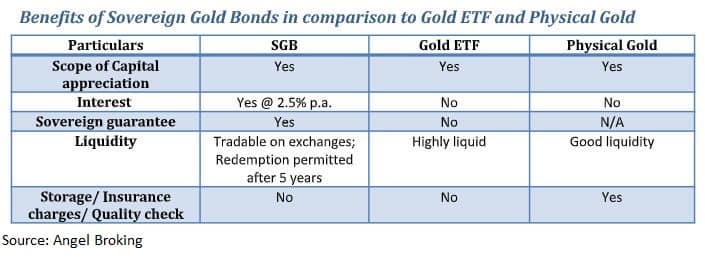

Which one of the two is better for you depends on your requirements. The rates of etf and sgb are linked to the physical gold rates. Investment in physical gold is highly susceptible to theft and burglary however if you invest in an etf or sgb then you can keep the investment safely.

If you want to invest in gold for long period then sgb is good for you as it comes with a maturity period of 8 years. Gold etf vs sgb. Moreover investing in sgb will give you additional interest at 2 5 p a which gold etfs won t. Since the benchmark of gold etf is physical gold price you can buy it close to the actual price of gold.

Sunny seth 272 views. Yadnya investment academy 35 419 views 8 20. Purity like gold etfs the sovereign gold bonds are also traded in non physical form but the prices are linked to the actual price of physical gold. 2 gold exchange traded funds etfs these are exchange traded funds which can be bought and sold on exchanges.

The expense of buying or selling sgb is very small in comparison to the physical gold. Lock in period the lock in period is a concerning issue with the gold bonds since it comes with a 5 year lock in period.